Saturday 3 January 2015

Wednesday 31 December 2014

Good Formula to Success

When You find these elements in one stock its a good formula for success:

- Revenue Growth 20% +

- Consistent Revenue Growth

- EBITDA Growth 40%+

- Profitable

- Ability to fund growth with internal cash flows

- Little to no debt

- No Institutional ownership

- No Analyst coverage

- Illiquid

- Operates in an emerging consumer trend

- Few public comps or trades at a fraction of comparable multiples

When You find a company with these attributes its usually only a matter of time until larger money starts to own it which can drive the stock price up significantly.To be successful investor ,you don't want to invest where the institutions are,you want to invest where they are going to go.

Tuesday 30 December 2014

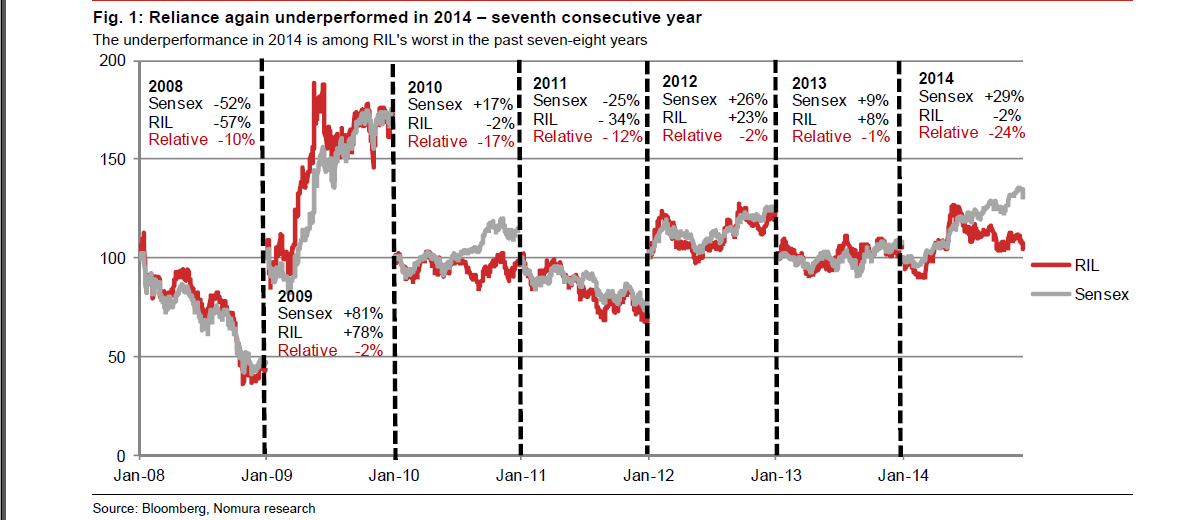

BUY RIL @ 880 by NOMURA

2014 disappoints; will 2015F see a turnaround?

So far 2014 has been disappointing for RIL: YTD, it has under performed BSE Sensex by

24%. This is the seventh successive year that RIL has underperformed, and we believe

RIL’s 2014 performance is likely to be among its worst.

We believe the sharp under performance this year was driven by further negative

developments in E&P (the low gas price hike virtually ensures that investment in E&P is

unlikely to begin anytime soon), high and rising spend in telecom (with not much clarity

yet on the timing and offering) and also a relatively weak petchem cycle.

We think the worst for E&P has already been priced into the shares. In 2015, investors

are likely to be eagerly awaiting the launch of telecom, and we think telecom

developments will be a driver for stock in near term. On the positive side, the ongoing

expansion in refining/petchem is likely to continue, and there should be increased

visibility on improved earnings growth from FY17F.

While we cut our near-term earnings estimates, ex-telecom, compared to an EBITDA

CAGR of just 3% over the past four years, we expect this to improve to a high 15% over

four years ending FY18F.With a sharp increase in RIL’s earnings growth visibility, we

think the long phase of relative underperformance is likely to end soon, and there could

be a turnaround of Reliance’s relative performance (vs Sensex) in 2015F.

Source: Nomura Research

Monday 29 December 2014

Subscribe to:

Posts (Atom)

COCHIN INTERNATIONAL AIRPORT

COCHIN INTERNATIONAL AIRPORT